Posted: 12 December 2023

Winning strategies for 2024 - creating 'deliverable' services

Accountants Minute 368

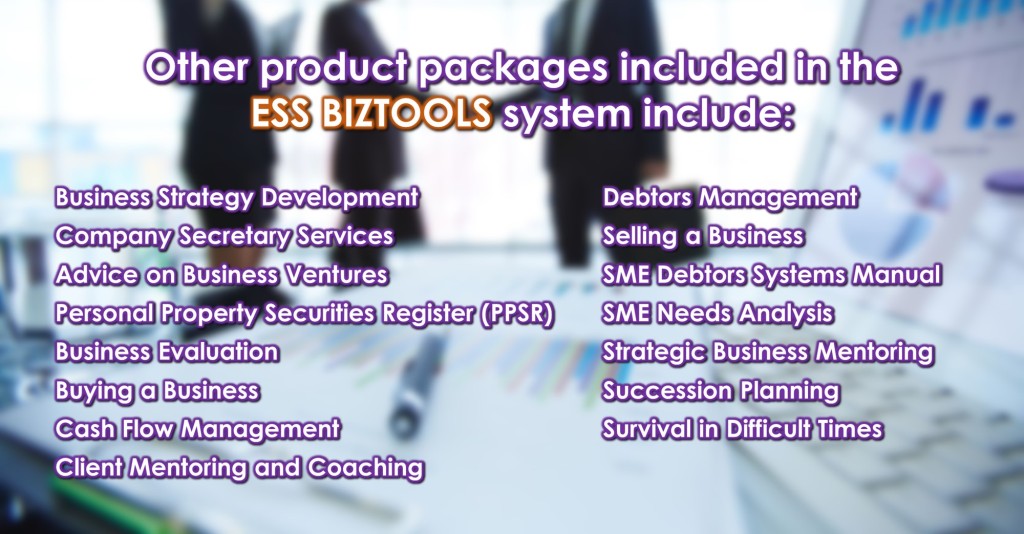

This is the continuation of the strategy two of our ‘WINNING STRATEGIES FOR 2024’ in which we identify Product Packages that will assist Accountants/Bookkeepers to ‘DELIVER ADVISORY SERVICES’.

Business Improvement Supporting Packages

Tradie Charge out Rate Calculator: enables you to analyse how your individual Tradie client conducts their business, their team members productivity, the mark-up on external purchases for the benefit of clients, overhead expenses and their desired profit to determine charge out rates to generate that profit target.

How many Tradie clients do you have? This could be a great service for your Tradie clients they will have far more information and for your firm.

Professional Service Firms Charge out Rate Calculator: very similar to the Tradie charge out rate calculator.

Retail/Wholesaler: determination of the mix of products and mark-up’s necessary to generate the targeted profit.

Research and Development (R&D): thousands of SMEs undertake R&D. Because of this, ESS BIZTOOLS has developed R&D package which covers from the very basic information – what entity you should be in if you wish to claim the R&D tax rebate – a company; through to the final documentation that is required to be submitted to AusIndustry and the ATO.

A report released by the Department of Industry, Science and Resources on 1 May 2023 commented on the R&D Tax Incentive Scheme, and their estimates of the value of the tax offset that is available for companies who have undertaken R&D expenditure in accordance with the rules. The report indicated that the estimated investment from the government in the R&D Tax Incentive for 2022/23 would be $3.2billion.

A report released by the Department of Industry, Science and Resources on 1 May 2023 commented on the R&D Tax Incentive Scheme, and their estimates of the value of the tax offset that is available for companies who have undertaken R&D expenditure in accordance with the rules. The report indicated that the estimated investment from the government in the R&D Tax Incentive for 2022/23 would be $3.2billion.

The report commented that there are two R&D tax offsets available under the R&D scheme, a refundable offset for firms with annual turnovers below $20million, and a non-refundable offset for firms above $20million turnover per annum.

The report noted “most of the schemes investment will come through the refundable offset at an estimated value of $2.54billion with the remainder being for the non-refundable offset.”

The $2.54billion of the tax offset equates to 43% of the expenditure. This means that R&D expenditure undertaken by companies with turnovers under $20million amounted to $5.9billion. This is a gigantic market that accountants offering advice to SME clients should be offering services to assist your clients in this process.

ESS BIZTOOLS has developed the product packages to assist you to deliver these services.

Board of Advice

These are becoming far more prevalent which is fantastic! ESS BIZTOOLS has developed a product package to guide you in offering advice to your clients on how a Board of Advice operates, which obviously includes the receipt of reports, preparation of meeting agendas, minutes of meetings and action plans resulting from the meetings.

Strategic Reviews

This is a great concept that a number of our subscribers are utilising to great success with their clients. The product package outlines the process which is a two-day event for your client’s leadership team, to review all aspects of their business and plan their next year’s operations. Our product package envisages that your role will be to organise in conjunction with your client the agenda and reports to be distributed a couple of weeks before the review meeting, to prepare minutes of the matters discussed and the action plan from the overall review.

Scaling up

This is a great process for many of your clients. It really doesn’t matter at what turnover level your client is at present. Your client currently might have a turnover of $700,000 and aspires to have a turnover of $3million in three years’ time. How are they going to undertake the ‘scaling up’ process?

You might have another client that already has a turnover of $7million and is aspiring to a turnover of $40million in five years’ time.

Both of these clients will need assistance and advice on the challenges that they are likely to encounter in this journey! What expenditure are they going to have to make for new facilities, training of their team members, patenting of new inventions, funding the business as it grows? Many of your clients will not understand that as their business grows. They need more capital to fund their inventory, debtors, work in progress as well as the capital expenditure.

Capital Raising

ESS BIZTOOLS has developed product packages to assist accountants and bookkeepers to give advice to clients on capital raising opportunities that are available for small SME companies:

Raising capital under Section 708 of the Corporations Act: up to $2 million in 12 months

Early-Stage Innovation Company: application for certification which will potentially encourage investors to invest in your clients’ company because of the significant taxation benefits that the investor receives. This particular company structure was legislated by the Australian government, to assist small SMEs to be able to raise capital. Unfortunately, many accountants servicing this market do not appear to have any knowledge of ESIC. We were recently contacted by a business operator who claims that he had contacted 16 accounting firms in three states trying to find out about the process to be deemed to be an ESIC. He was eventually referred to us! This is a real opportunity to assist small businesses that are on the ‘Innovation Journey’.

Early-Stage Innovation Company: application for certification which will potentially encourage investors to invest in your clients’ company because of the significant taxation benefits that the investor receives. This particular company structure was legislated by the Australian government, to assist small SMEs to be able to raise capital. Unfortunately, many accountants servicing this market do not appear to have any knowledge of ESIC. We were recently contacted by a business operator who claims that he had contacted 16 accounting firms in three states trying to find out about the process to be deemed to be an ESIC. He was eventually referred to us! This is a real opportunity to assist small businesses that are on the ‘Innovation Journey’.

Crowd Sourced Funding Equity Raising: this capital raising methodology is available for companies with turnovers under $25million who can raise up to $5million in a 12-month period, and who can repeat the process in following years if they wish, and as long as they get support from investors. Millions of dollars have been raised in this process over the last six years.

This is a brief overview of the product packages that are available within ESS BIZTOOLS, to assist you to have access to material that will enable your Accounting/Bookkeeping firm to ‘deliver outstanding business improvement services which your clients will pay for, not just include information on a website indicating your firm is offering these services’.

We are offering you a SPECIAL DISCOUNT PACKAGE for you to take advantage of these outstanding product packages to assist you to deliver ‘DIFFERENTIATED SERVICES TO YOUR CLIENTS AND PROSPECTS IN 2024’.

We look forward to your firm becoming a member subscriber of ESS BIZTOOLS PRIOR TO THE CLOSING DATE OF THIS SPECIAL OFFER TUESDAY, 19 DECEMBER 2023.

MERRY CHRISTMAS and BEST WISHES FOR A SAFE AND SUCCESSFUL 2024!

ESS BIZTOOLS Special Promotion

Now is the time to get organised to be able to deliver an outstanding range of ‘BUSINESS IMPROVEMENT SERVICES FOR YOUR CLIENTS’. To assist you on this journey ESS BIZTOOLS is offering a ‘SPECIAL PROMOTION UNTIL 19 DECEMBER 2023’:

- 20% discount on our product packages

- Holiday accommodation voucher for subscribers- for details click here

- Financial Forecasting Package – 3 vouchers

- Advanced Package – 2 vouchers

- Starter Package – 1 voucher

Financial Forecasting Package

Financial Forecasting Package

Special Christmas discount – $726.40 (GST inclusive) 12 x monthly or upfront discounted price (GST inclusive) $7,920 – for details click here.

Advanced Package

Special Christmas discount – $476.80 (GST inclusive) 12 x monthly or upfront discounted price (GST inclusive) $5,200 – for details click here.

Starter Package

Special Christmas discount – $157.60 (GST inclusive) 12 x monthly or upfront discounted price (GST inclusive) $1,680 – for details click here.

Let’s look at the some of the great product packages that you will have to be able to deliver BUSINESS IMPROVEMENT SERVICES to your clients and prospects and to get a great start in 2024!

Delivering Advisory Services

ESS BIZTOOLS has produced a special presentation this week: Delivering Advisory Services - a series of videos that provide an overview of what's contained within ESS BIZTOOLS and how they can assist your firm deliver the type of 'ADVISORY SERVICES' your SME clients require.

Click on your preferred segment below to watch:

Part 1: Business Plus+ newsletter, Sections and Papers, Research and Development

Part 2: Early Stage Innovation Company Package

Want to know more?

Visit www.essbiztools.com.au.

If you would like to have a discussion about how this concept of virtual CFO services can be supplied by Australian accounting firms please ring our Managing Director, Peter Towers, on 1800 232 088 and we will arrange a complimentary 45-minute Zoom meeting to discuss your firm’s position and to give you our advice.

We believe that this is the blueprint for the delivery of an enhanced range of services by Australian accounting firms to assist SME businesses to add value to their businesses and to assist accountants not only to attract but to retain outstanding talent who want to be involved in the delivery of “real accounting services”.

Tell us what you think

We would like to ensure that our articles remain relevant, insightful and informative. We value your input, so it would be appreciated if you could take a few minutes of your time to complete our survey – click here.

We would like to ensure that our articles remain relevant, insightful and informative. We value your input, so it would be appreciated if you could take a few minutes of your time to complete our survey – click here.

Thank you for your assistance in making Accountants Minute better.

Subscribe to Accountants Minute

Want to keep up to date with the latest issue of our Accountants Minute newsletter?

Click here to subscribe, free of charge.