Introducing the Business Advisory Services (BAS)

Starter Package

The Business Advisory Services Starter Package is our implementation program that teaches accountants how to profitably make the transition from compliance to high-level Business Advisory Services and get your first (or next) advisory client.

It doesn't matter if you don't have any advisory skills or any previous experience beyond compliance. Everything you need to know is provided step-by-step in this package.

This package is remarkably different to the training provided by the professional accounting bodies or anyone else in the market.

It contains the perfectly designed mix of one-on-one and group coaching/mentoring, along with 'ready-to-go' marketing materials and client engagement workpapers that we have already created and stored inside our subscriber content portal.

It's the shortcut you need to start winning and delivering higher-value business advisory services with confidence.

The Perfectly Engineered Change Agent

To get started in providing Business Advisory Services and transforming your accounting firm, content is not enough. You need an immersive environment.

Proven Process

We've turned the unknown, grey area of how to best get started in providing Business Advisory Services into a precise science. While the professional accounting bodies and others provide general training, we use a predictable process. Our methodology has been crafted for over 20 years and applied in hundreds of Accounting firms Australia wide.

Winning Community

It's hard to change your firm when you're surrounded by the people you've always been with. Our subscribers join a community of others on the same path so that the idea of transitioning from compliance to advisory isn’t laughed at but achieved on a daily basis.

Experienced Mentorship

Everyone needs help and advice when tackling new challenges, but true experts are out of reach for most people. Our subscribers get one-on-one access to Peter Towers, an accountant and Business Advisory Services expert who ditched compliance in exchange for a variety of business advisory related services over 22 years ago. You’ll be mentored by someone who has actually provided these services successfully.

‘Ready to go’ marketing materials and workpapers/checklists

When you join the Business Advisory Services Starter Package, you won’t need to spend hours re-inventing the wheel. We have already developed proven, easy to follow engagement templates, checklists and marketing material to support you in providing these higher-value services to both new and existing clients. Just put on your logo and away you go.

Peter Towers, Experienced Accountant & Mentor

ESS BIZTOOLS is the brainchild of experienced accountant and mentor, Peter Towers.

Peter Towers an experienced and well-respected professional Accountant, having worked in a variety of Accounting, Company Secretary and Business Consulting positions over a 40+ year career, including:

-

Chief Financial Officer/Company Secretary of a Listed Public Company;

-

Principal of an Accountancy Practice;

-

Consultant for a major Australian Government Grant Program administered via AusIndustry – “Commercialising Emerging Technology”; and

-

Over 20 years as a Business Advisory Consultant to accountants and small businesses and medium-sized Enterprises, personally delivering a broad range of Business Advisory Services.

Peter understands the real-world challenges that Accountants face in building a business advisory services division within their firms and has developed proven, easy to follow marketing materials and templates to support you and your team in providing such services to your clients.

Business Advisory Services Starter Package Content and Schedule

We'll give you the short-cuts and help you get started in providing Business Advisory Services to clients from scratch, here's how:

1. Business Advisory Services Firm Training

Our foundational firm training modules show you step-by-step how to get started in executing Business Advisory Services Engagements with an in firm training program set out for you.

You and/or select members of the team read the training materials at your own pace.

By the end of this foundational training, you'll have the confidence and know-how needed to start executing Business Advisory Services engagements with clients.

This core training is worth the price of admission alone!

Here's what we cover during the training:

- Introduction to Business Advisory Services

- Getting your firm organised for Business Advisory services

- Offering Business Advisory Services

- Team Training for Business Advisory Services

- Leadership Strategies for Business Advisory Services

- Marketing Strategies for Business Advisory Services

- Review of Product Services that could be Offered

- Use of SME Needs’ Analysis

- Selection of products to be offered Product Champions

- Planning Seminar to launch Business Advisory Services

- Selling Business Advisory Services

- Implementation of Business Advisory Services

- One on One Meetings for Business Advisory Services

2. One-On-One Training / Group Webinars / Additional Training

As a new subscriber to the Business Advisory Services Starter Package, your firm will receive 1 x 30 minutes training session for your firm.

This session gives your firm an overview of the system package to inform your firm on the delivery of Business Advisory Services.

In addition, you'll receive access to our monthly group webinar for our subscribers. Hosted by Peter Towers, these webinars allow you to ask questions on an ongoing basis, and learn from other subscribers who are executing Business Advisory Services within their firms. The theme for each webinar will relate to a Product Package within ESS BIZTOOLS.

Can't make a live webinar? No problem - each webinar is archived and made available as a recording for you to listen to at your leisure.

If you require additional training / mentoring, no problems, your firm can subscribe for additional training at a day and time to suit you and you can specify the items to be covered.

3. Business Advisory Services Monthly Newsletter Written For You

In order to make the transition from compliance to business advisory, it's important that clients see you and your firm as being a well-rounded business advisor - not just someone who lodges their tax returns.

Our Starter Package subscribers will receive access to our Business Plus+ monthly newsletter.

This is a monthly newsletter we produce internally for our subscriber firms for them to use as a marketing resource with their clients.

Simply replace our logo with yours and send it off to your clients or prospect mailing list.

Click here to access a sample edition of Business Plus+.

You'll be amazed at the new engagement opportunities and conversations this will generate amongst your network.

Business Plus+ is produced monthly with two 'bonus' additional editions produced in May:

- "Federal Budget as it Affects SMEs"

- "End of Financial Year Tax Planning"

It includes information on a range of business advisory items, which will encourage your clients to use a wider range of services from your accounting firm.

4. Client Seminars/Webinars

These are PowerPoint presentations that we have prepared for you on topics related to Business Advisory Services.

All you need to do is put your logo on them, practice a few times, and then get presenting in front of clients!

Each package also includes explanatory article(s) and forms to enable the accountant to supply “branded take away material” to participants.

Perfect for running live webinars over zoom or face-to-face.

In our experience, speaking is one of the quickest ways to establish yourself as a credible expert. Don't spend hours creating these yourself - simply take ours and make them your own.

You'll gain access to 12 pre-made seminar/webinar presentations, each covering a separate topic:

- The Beginning of Business Management

- Business Bookkeeping

- Business Management – Firm Foundations

- Management of the Business of Business

- Family Businesses

- Buying A Business

- Differentiate Your Business

- Setting Prices and Fees

- Key Performance Indicators

- Characteristics of a Well Run Business

- Introduction to Family Businesses

- Early Stage Innovation Company

5. Client Mentoring and Coaching Modules

This is part of the process of sending your client information to demonstrate that they have made the right decision to engage you and that you can deliver on their requirements.

It provides an engagement outline and the material for you to send to your clients, over time, relating to the services they have hired you to perform.

Subscribers to the Business Advisory Services Starter Package receive access to the following mentoring and coaching modules:

- Purchasing or Commencing Business

- Introductory Management

- Preparation and use of Periodic Financial Accounts

- Family Business

6. Debtors’ Management Engagement

Debtors’ management is an enormous problem for the majority of small/medium enterprises in Australia.

The Australian “debtors’ days outstanding” is the “longest in the world!”.

This package assists accountants/business advisers to implement an engagement with clients specifically around improving the client's Debtors’ Management Systems.

Conduct a Due Diligence Review periodically and update the manual or mentor your client’s team members as required.

7. Survival In Difficult Times Product Package

This product package contains a detailed evaluation process based on 38 questionnaires which will enable you to assess the financial health and performance of virtually any type of business.

The questionnaires are linked to commentary contained within explanatory articles which the presenter is able to supply to participants to give them “branded take away material” for them to read at their leisure and perhaps this will prompt further questions to ask their accountant which could lead to additional professional services.

8. Industry Specific Advisory Product Packages

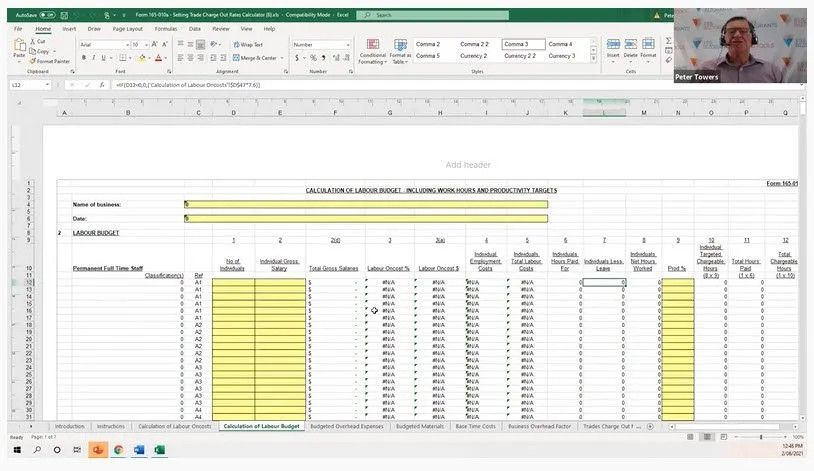

This package includes calculators for:

- Determination of charge out rates for Tradies to assist in generating targeted profits.

- Retail pricing calculator to facilitate an analysis of product mixes and mark-ups to assist retailers to generate targeted profits.

- Professional services firms charge out rate calculators to assist professional firms to calculate charge out rates sufficient to generate targeted profits.

- Business Health Checks – for five business groups at present.

- Clothing Retail

- Commercial Building Industry

- Pharmacy

- Supermarkets

- Road Transport

9. ESS Papers

Access to 343 papers from the ESS BIZTOOLS Library which contain further marketing material and show you step-by-step how to execute specific components of business advisory services engagements with clients.

These papers are used both for your purposes (i.e. to understand the service and 'flow' of the engagement), as well as for you to provide as deliverables to clients (with your logo, of course).

9. ESS Papers (Continued...)

You’ll get access to the following sections which contain access to the explanatory papers:

001 - Beginning in Business

- 001-001 - Small Business Overview

- 001-002 - Pitfalls In Starting A Business

- 001-003 - Business Set Up And Purchase

- 001-004 - Rating Chart To Assess Your Strengths And Weaknesses

- 001-005 - Who Can Assist Small Business Operators?

- 001-006 - Have You Got Enough Money To Go Into Business

- 001-007 - What Makes A Business Successful?

- 001-008 - Small Business Restructure Rollover

- 001-015 - Co-Ownership Agreements

- 001-020 - Hints On Buying A Small Business

- 001-031 - Payroll Tax

- 001-032 - Land Tax

- 001-033 - Introduction To Insurance

- 001-050 - Sources Of Finance

- 001-060 - Weekly Performance Estimate Reports

- 001-070 - Purchasing A Business Checklist

002 - Bookkeeping Systems

- Paper 002-001 - Why Maintain Accounting Records.doc

- Paper 002-002 - Recording Of Business Transactions.doc

- Paper 002-003 - Cash And Cheques Payments Cycle - Manual Accounting.doc

- Paper 002-004 - Cash Payments Exercise.doc

- Paper 002-020 - Petty Cash Record Keeping.doc

- Paper 002-021 - Petty Cash Exercises.doc

- Paper 002-029 - Important Documents Asset Ownership.doc

- Paper 002-030 - Fixed Assets Control.doc

- Paper 002-035 - Working Capital Lifeblood Of A Business.doc

- Paper 002-036 - Credit Sales And Debtors.doc

- Paper 002-038 - Introduction To Factoring.doc

- Paper 002-040 - Cash Receipts.doc

- Paper 002-041 - Cash Receipt Exercises.doc

- Paper 002-050 - Handling Of Cash.doc

- Paper 002-055 - Filing.doc

- Paper 002-060 - Bank Reconciliation Statements.doc

- Paper 002-061 - Bank Reconciliation Statement Exercises.doc

- Paper 002-070 - Payroll Records.doc

- Paper 002-074 - Owned Business Premises.doc

- Paper 002-075 - Leased Premises.doc

- Paper 002-076 - Building Tenancies.doc

- Paper 002-080 - Stock Inventory Control.doc

- Paper 002-085 - Chart Of Accounts.doc

- Paper 002-090 - Good Bookkeeping Habits Help Run A Successful Business.doc

003 - Business Entities

- 003-001 - Business Structures

- 003-010 - Sole Trader

- 003-015 - Partnership

- 003-020 - Discretionary Trusts

- 003-025 - Unit Trusts

- 003-030 - Companies Incorporated Before 30th June 1998

- 003-035 - Companies Limited By Guarantee

- 003-040 - Companies

- 003-041 - Unlisted Public Companies

- 003-045 - Early Stage Innovation Companies

- 003-046 - Self Assessment For Early Stage Innovation Company

- 003-047 - Participant's Workbook for ESIC Seminar

- 03-055 - Crowd Sourced Funding - Equity Raising Overview

- 003-056 - Crowd Sourced Funding - Post Capital Raising

- 003-070 - Associations Incorporation Act

004 - Business Systems

- 004-001 - Why Keep Records?

- 004-002 - Stationery, Books And Filing Checklist

- 004-003 - Using A Computer For Record Keeping

- 004-010 - Business Records

- 004-011 - Systems Required To Obtain A Taxation Deduction For Motor Vehicle Expenses

- 004-020 - Records Required For Financial Year End

- 004-040 - Flowchart Of Retail Business Operations

- 004-060 - Systems For Business

- 004-070 - Internal Control and Systems Review

005 - Accounting Reports & Terminologies

- 005-001 - Accounting Terminology

- 005-002 - Ratio Analysis

- 005-003 - Working Capital Control

- 005-005 - Sundry Debtors

- 005-010 - Work In Progress

- 005-011 - Stock Management

- 005-015 - Trading And Profit And Loss Statement

- 005-016 - Trading And Profit And Loss Statement Ratio Analysis

- 005-025 - Balance Sheet

- 005-026 - Balance Sheet Ratio Analysis

- 005-030 - Statement Of Source And Application Of Funds

- 005-033 - Interpretation Of Financial Accounts

- 005-035 - Budgets And Cashflow Forecasts

- 005-036 - Cashflow Management for SMEs

- 005-050 - Management Departmentalised Accounts

- 005-051 - Profit Centres For Owned Premises

- 005-060 - Sundry Creditors

- 005-080 - Bank Account

- 005-090 - Loans

- 005-091 - Hire Purchase Agreements

- 005-092 - Leases

- 005-093 – WorkCover

- 005-095 - Provision For Personal Leave and Holiday Pay

- 005-096 - Provision For Long Service Leave

006 - Operating A Successful Business

- 006-001 - Personal Leadership Capacity And Development

- 006-010 - Break Even Calculation

- 006-036 - What Makes You Different - Your Competitive Edge

- 006-073 - Introduction To Key Performance Indicators For SMEs

- 006-074 - Using Key Performance Indicators To Create Value For SMEs

- 006-075 - Performance Measures For Key Performance Indicators

- 006-076 - Check List For KPIs That Might Be Suitable For A SME

- 006-077 - Sample of KPIs

- 006-080 - Characteristics Of A Well Run Business

- 006-081 - Steps Needed To Achieve Business Success - An Overview

- 006-085 - Business Evaluation for SMEs

- 006-090 - Benchmarking For SMEs

007 – Media

- 007-001 - Creating Effective Media Relations

008 - Marketing

- 008-001 - Marketing - An Overview

- 008-005 - Marketing Yourself - Key Points

- 008-010 - Direct Marketing

- 008-040 - Marketing For Small Business

- 008-050 - Development Of A Marketing Plan

- 008-060 – Sponsorship

009 - Business Planning

- 009-001 - Business Plan Overview

- 009-003 - Business Planning Benefits And Suggestions Re Preparation

- 009-005 - Guide To The Preparation Of A Business Plan

- 009-006 - Why Do Strategic And Business Planning?

- 009-008 - Business Plans - Key Points To Be Included

- 009-010 - Planning Your Business - Small Business

- 009-020 - Planning To Succeed

- 009-021 - What Is A “Swot” Analysis?

- 009-053 - Sundry Work To Be Undertaken As Part Of The Business

- 009-070 - Monitoring Implementation Of The Business Plan

- 009-080 - Writing The Plan To Make Your Business A Winner

- 009-081 - Use Of The Business Plan Questionnaire To Assist In Writing The Business Plan

- 009-082 - Strategies For Making Profits

010 - Family Businesses

- 010-001 - Family Businesses - What Are They?

- 010-005 - Family Businesses - Making Them Work

- 010-006 - Planning The Family Business

- 010-007 - Family In The Business

- 010-010 - Disputes In Family Businesses

- 010-011 - Marriage Breakdown - Effect On Family Businesses

- 010-020 - Business And Family Investments

- 010-030 - Directors Of Family Companies

- 010-036 - Bringing In Outside Management

- 010-060 - Business Structures For Family Businesses

- 010-064 - Family Charter/Constitution

- 010-066 - Estate Planning In Family Businesses

- 010-067 - Retirement Planning In Family Businesses

011 - Banks And Financiers

- 011-001 - Banks And Financiers - An Overview

- 011-010 - Finance Applications

- 011-020 - Relationship With Banks And Financiers

012 - Taxation

- 012-001 - Taxation In Australia - Introduction

- 012-005 - Australian Business Number

- 012-009 - Research And Development Tax Incentive

- 012-011 - R and D Eligibility Check List For Tax Incentive

- 012-015 - Tax Planning For Business People

- 012-016 - PAYG Withholding Payment To Employees

- 012-017 - PAYG and Labour Hire Arrangements

- 012-018 - PAYG Voluntary Agreements

- 012-019 - PAYG Withholding - Payments to Businesses Who Have

- 012-020 - Capital Gains Tax - Introduction

- 012-021 - Capital Gains Tax Concessions For Small Business

- 012-023 - PAYG Instalment System

- 012-025 - Fringe Benefit Tax - Introduction

- 012-030 - Turnover Under $75,000 - Specific Taxation Issues

- 012-031 - Turnover $75,000 to $2m - Specific Taxation Issues

- 012-035 - Turnover $2M To $20M Specific Taxation I

- 012-045 - Company Tax

- 012-046 - Discretionary Trusts - Taxation Treatment

- 012-047 - Unit Trusts - Taxation Treatment

- 012-048 - Family Trusts - Rules Applicable To Discretionary

- 012-049 - Checklist For A Discretionary Trust To Determine Whether It Should Be A Family Trust

- 012-050 - Tax Assessments

- 012-051 - Family Trusts - Rules Applicable To Unit Trusts

- 012-058 -Tax Incentives for Early Stage Investors

- 012-060 - Planning Can Help You Reduce Income Tax

- 012-066 - Taxation Time - Records That The Business Systems Should Be Able To Produce

- 012-067 - Personal Services Income

- 012-068 - Employee Share Schemes

- 012-070 - Tax Audits

- 012-071 - Hints On Handling A Tax Audit

- 012-072 - Questions To Be Asked By The ATO

- 012-073 - ATO Small Business Benchmarks

- 012-075 - Types Of Questions Asked In A Record Keeping Audit

- 012-076 - Types Of Questions Asked In A Tax Business Audit

- 012-081 - Tax Planning - Sale Of A Business By An Individual

- 012-091 - Tax Planning - Purchase Of A Business

- 012-092 - Buy Sell Agreements Tax Effects

- 012-095 - Taxation Compliance Questionnaire

013 - Corporate Governance

- 013-001 - Corporate Governance Issues Affecting SMEs

- 013-005 - Director’s Checklist

- 013-010 - Corporate Duties To Be Allocated

- 013-030 - New Director Information Pack

- 013-070 - Company Secretary's Duties

015 – Exporting

- 015-001 - Exporting Overview

- 015-030 - Austrade

- 015-070 - Export Finance Australia Overview

016 - Legal

- 016-001 - What Legal Advisors Can Do For You?

017 - Human Resources

- 017-001 - Planning To Hire A New Employee

- 017-002 - Advertising For Employees

- 017-003 - Why Would Applicants Want To Apply To Your Business

- 017-004 - Reviewing The Applications

018 – Customers

- 018-001 - Customer Service

020 – Goods and Services Tax

- 020-001 - Goods And Services Tax An Overview

- 020-002 - GST As It Affects SMEs

021 - Business Planning Questionnaire

- 021-001 - Review Of Business

- 021-002 - Financial Analysis

- 021-003 - Business Situation Analysis

- 021-004 - Business Objectives

- 021-005 - Resources

- 021-006 - Uncontrollable Environmental Factors

- 021-007 - Computers And Other Technology

- 021-008 - Products/Services/Supply Chain

- 021-009 - Industry And Market Research

- 021-010 - Experience

- 021-011 - Customers/Clients

- 021-012 - Location

- 021-013 - Competitors

- 021-014 - Marketing

- 021-015 - Advertising

- 021-016 - Manufacturing

- 021-017 – Suppliers

- 021-018 - Quotes/Proposals/Orders

- 021-019 - Costing

- 021-020 - Business Pricing

- 021-021 - Packaging

- 021-022 - Sales

- 021-023 - Distribution

- 021-024 - Operating The Business

- 021-025 - Exports

- 021-026 - Staff Development

- 021-027 - Staff Training

- 021-029 - Imports

- 021-030 - Human Resources

- 021-031 - Debtors

- 021-032 - Stock

- 021-033 - Work In Progress

- 021-034 - Benchmarking

- 021-035 - Budgets/Cashflow Forecast Preparation

- 021-036 - Taxation

- 021-037 - Periodic Financial Accounts

- 021-038 - Budgets/Cashflow Forecasts Monitoring

- 021-039 - Bank Relationship

- 021-040 - Business Funding

- 021-041 - Organisational Matters

- 021-042 - Research And Development

- 021-043 - Insurance

- 021-044 - Quality Assurance

- 021-045 - Business Structures

- 021-046 - Board Of Advice/Directors

- 021-047 - Advisors

- 021-048 - Legal

- 021-049 - Public Relations

- 021-050 - Business Outlook In Your Area

- 021-051 - Management

- 021-053 - Company Administration

- 021-054 - Annual Review

- 021-055 - Risk Management/Contingency Plan

- 021-056 - Sensitivity Analysis

- 021-057 - Writing The Business Plan

- 021-058 - SWOT Analysis

- 021-062 - Succession Planning

- 021-063 - Personal Plan

- 021-064 - Business Relocation

024 - Insurance

- 024-001 - Insurance - An Overview

025 - Time Management

- 025-001 - Managing Your Time

026 - Superannuation

- 026-001 - Superannuation An Overview

029 - Risk Management

- 029-004 - Risk Management - What Is It?

- 029-005 - Risk Management for SMEs – Introduction

036 - Selling A Business

- 036-001 - When is the Best Time to Sell?

- 036-050 – Valuation of a Business

037 - Cost Control

- 037-001 - Cost Control An Overview

- 037-005 - Accountancy Fees

- 037-007 - Administration Service Charges

- 037-008 - Audit Fees

- 037-009 - Agent's Commission

- 037-010 - Bank Charge

- 037-015 - Cleaning

- 037-022 - Depreciation

- 037-028 - Electricity

- 037-040 - Insurance Expense

- 037-041 - Interest Expense

- 037-047 - Lease Payments

- 037-048 - Legal Costs

- 037-051 - Loss On Sale Of Fixed Asset

- 037-052 - Land Tax Expense

- 037-055 - Maintenance And Warranty Agreement Cost

- 037-064 - Pest Control

- 037-070 - Rates (Local Government)

- 037-072 - Rent External

- 037-074 - Repairs And Maintenance

- 037-078 - Security Expenses

- 037-091 - Valuation Expenses

- 037-092 - Water Rates And Charges

038 - Networking

- 038-001 - What Is A Network?

- 038-002 - Introduction To Networking

040 - Investment Readiness

- 040-001 - Preparation For Investment Readiness

050 - Succession Planning

- 050-050 - Succession Planning - Why Is It Necessary?

- 050-051 - Financial Considerations In Succession Planning

- 050-052 - Succession Problems

- 050-053 - Management Issues In Succession Planning

- 050-054 - Financing Succession

- 050-055 - Checklist For Succession Planning

051 - Personal Property Securities Act

- 051-005 - Personal Property Securities Register

055 - Professional Selling

- 055-010 Who Is Your Sales Person?

060 - Non-Government Grants and Assistance

- 060-011 - Coal Industry Scholarship

014 - Government Grants and Assistance

- 014-001 - Using Government Grants

495 - Improving Your Bottom Line

- 495-003 - Identify The Services You Want To Receive From Us

- 495-011 - Crowd Sourced Funding Equity Raising Package

- 495-012 - Sick of Borrowing Money Crowd-Sourced Funding Might Be The Answer

500 - Accountancy Business Development

- 500-001 - Creating Business Advisory Services For Clients

- 500-002 - Development of a Business Development Enterprise

- 500-003 - Team Building for a Dynamic Accountancy Firm

- 500-006 - Management of the Business Development Enterprise

- 500-010 - Business Development Strategies for Accountants

- 500-020 - Using The Accountancy Business Development Checklist

- 500-021 - Fixed Price Agreements For Accountancy Firms

- 500-030 - Chief Financial Officer's Report on Financial/Management Accounts

- 500-031 - Chief Financial Officer's Weekly Report

- 500-051 - Key Performance Indicators for Accountants

- 500-060 - Marketing Strategies for Accountancy Firms

- 500-070 - Turning Your Accountancy Business Into A Client Business Centre

- 500-071 - Future Services That You Can Offer Your Clients

- 500-072 - Deliver Non-Compliance Services That Add Value

- 500-073 - From Compliance To Business Advisory Services

- 500-074 - Opportunities From Digital Disruption

- 500-075 - How to Earn Fees from ESS BIZTOOLS

501 - Accountancy Business Development Training

- 501-003 - Introducing a Business Advisory Service Culture

- 501-010 - Financial Accounts Strategies

- 501-011 - Preparing Financial Accounts

- 501-012 - Management Accounts To Deliver Business Development Strategies

- 501-013 - Business Development Strategies Exercise

- 501-014 - Best Practice Business Unit

- 501-015 - Encouraging Client Business Units

- 501-020 - Work Papers

- 501-021 - Current Files

- 501-090 - Preparing A Client To Raise Capital

- 501-091 - Coaching A Client To Investment Readiness

502 - Accountancy Business Development Activities

- 502-011 - Approach to a Business Plan Assignment

- 502-012 - Work Code Numbers For The Preparation Of Business Plans

- 502-013 - Information Required From A Client To Prepare A Business Plan

- 502-015 - Business Plan Control Sheet

550 - Business Coaching

- 550-001 - Advice That Your Clients Want

- 550-010 - Preparing Financial Analysis Using Software Products

- 550-040 - Professional Selling for Improved Results

- 550-060 - Business Advisory Services Readiness

570 - Business Advisory Services

- 570-001 - Introduction to Business Advisory Service

- 570-011 - Team Training for Business Advisory Services

- 570-013 - Marketing Strategies for Business Advisory Service

- 570-014 - Review of Products Services That Could be Offered

- 570-015 - Use of SME Needs Analysis

- 570-016 - Selection of Products to be Offered and Appointment of Product Champions

- 570-017 - Planning Seminar to Launch Business Advisory Services

- 570-018 - Selling Business Advisory Services

- 570-034 - Debtors Management

- 570-036 - Business Evaluation Workshop

- 570-040 - Chief Financial Officers Services

- 570-042 - Business Planning Consultancy

Absolute Satisfaction Guarantee

Our packages are proven with hundreds of happy subscriber firms all across Australia. However, if you're still unsure about joining, we offer a full 60-day money-back guarantee. Try the program risk-free and if you're not completely satisfied with ESS BIZTOOLS, we'll gladly refund you in full.

What A Few Of Our Subscribers Are Saying

Jackie Symons

CPA and Partner, Professional Insights

“We love the one-on-one zoom sessions with Peter. It really has allowed us to tailor the materials to our clients and circumstances. The mentoring and support from a genuine expert is just something you don’t get anywhere else.”

Russell Laird

Chartered Accountant and Principal, O’Regan Partners

“For the past 7-years, Peter and the team at ESS BIZTOOLS has helped us cover a broad and essential range of business advisory services. Peter and his material have helped coach us in providing presentations and seminars for clients, how to market business advisory services to clients and how to recognize which clients need what. On top of that, they provide you with the tools to execute the engagements which save us a tremendous amount of time and effort.”

Angelo Coco

Chartered Accountant & Principal, Family Business Support

“The ESS tools and papers are really helpful, ready to go and they just work. Some tools I've used in serving my clients over 100 times, I recommend the ESS tool kit to other practitioners at any opportunity I get”.

Please Note: 50% upfront payment.

After each session 50% of the effective hourly fee – payable within 30 days.

Optional Extras

Additional Support – Business Advisory Services

Should you require additional support or assistance ESS BIZTOOLS will provide the following:

-

1 hour Training Session: PRICE: $ 440 (inclusive of GST)

-

3 x 1 hour Training Session: PRICE: $1,221 (inclusive of GST)

-

6 x 1 hour Training Session: PRICE: $2,376 (inclusive of GST)

-

12 x 1 hour Training Session: PRICE: $4,488 (inclusive of GST)

At Each Training Session

-

You are welcome to submit discussion points (please send 48 hours prior to the session time)

- We will conduct a Briefing Review on the Action your firm has taken on the previous session Action Plan.

You will receive after each Training Session

- Video recording of the Training Session

- Action Plan for the matters discussed

Frequently Asked Questions

Have a question about the BAS Starter Package? Check out our frequently asked questions and answers

I’m already a member of one or more of the professional accounting bodies. How is the Business Advisory Services Starter Package different to the information I can purchase there?

The professional accounting bodies provide wonderful information across a broad range of topics. However there is nothing in the market place that provides the right mix of one-on-one mentoring, proven workpapers, marketing materials and templates that allow you to hit the ground running .

You can keep studying theory and collecting general information. Alternatively, you can take a shortcut and get the one-on-one support and materials which you can apply to your own specific firm and circumstances by joining our business advisory services starter package. If you’re ready to get on the fast track, there really is nothing better.

How do I know what type of Business Advisory Services are right for me and my clients?

There's no “magic service” that will apply to every firm and circumstance. You need to go through this process yourself and we show you exactly how to do this as part of this package.

We provide the one-on-one sessions with Peter for the primary reason of understanding the exact opportunities that exist within your firm today, and then directing you how to execute such services by leveraging our extensive range of workpapers and materials.

Don't worry about the exact services you’ll provide. Join and then we figure that out together. We have a full process for this.

We also have a number of additional product packages in addition to this starter package, including but not limited to the 'Virtual Chief Financial Officer' package, '52 Week Business Enhancement System' package, 'Corporate Governance' package, 'Early Stage Innovation Company Capital Raising' package, 'Crowd Sourced Equity Funding' package and 'Research & Development' package.

Start with the foundations covered under this starter package here and move forward as your experience, confidence and clients' needs progress.

How much time do we need to commit to this? Can I do this whilst managing my existing compliance-related workload?

Yes it will work for you, we understand that most accountants are very busy managing their existing compliance related workload. We also know you have families, commutes and hardly any free time. We have designed this starter package so that you can work through it even if you're hard-pressed for time. It doesn't matter what your schedule is like, if you can set aside at least 2 hours per week you will be able to work your way through it.

Even if you can't start right away…reserve your spot and go at your own pace. You can log in whenever you want to.If you're asking about our monthly group webinars, those are live and you can view the recordings at a time suitable for you.

If you elect to subscribe to a one-on-one webinar for your firm, we will set the Zoom meeting on the day and time your firm nominates and we will supply the video recording so that your team members can watch it at a time suitable for them.

How long until I see results in my firm from this package?

So that will totally depend on how quickly you work through our materials and how quickly you take action. Some people start making money with new services within the first week of joining, while others work their way through slowly and it takes longer.

How do I know I can trust Peter and ESS BIZTOOLS?

I've been providing Business Advisory Services to real businesses via my firm 'Towers Business Development' for over 20 years.

You can go to our website www.towersbusiness.com.au and look for yourself. I ditched compliance entirely over 20-years ago and have been providing business advisory services ever since. This is my life's work, my results are proven and our subscriber firms' results are proven.

The reality is that there is no one in the Australian marketplace that has more experience than me in this subject area. It's my personal mission at this stage of my career to provide as much of my knowledge as I can to the next generation of business advisors who want to do more and contribute more to the success of their team and clients.

Apply for Free Strategy & Demonstration Session

We know you're busy managing both your team and existing client engagements. Sometimes it helps to simply talk to someone to discover exactly how we can support your specific firm. That's why we offer qualifying accounting firms an initial, no-obligation 45-minute strategy and demonstration session. Every firm has different opportunities and the plan we will create together will be tailored to your practice, background, experience and comfort level.